DHL reveals Black Friday trends: 84% of online retailers bank on sales surge - fueled by younger generation

With November and December identified as the busiest trading months for retailers, Black Friday acts as a catalyst for year-end performance.

- Recent DHL eCommerce Trends Reports reveal that nearly nine out of ten retailers are gearing up to take part in Black Friday 2025, as 60% of them experienced increased sales revenues in 2024 compared to 2023

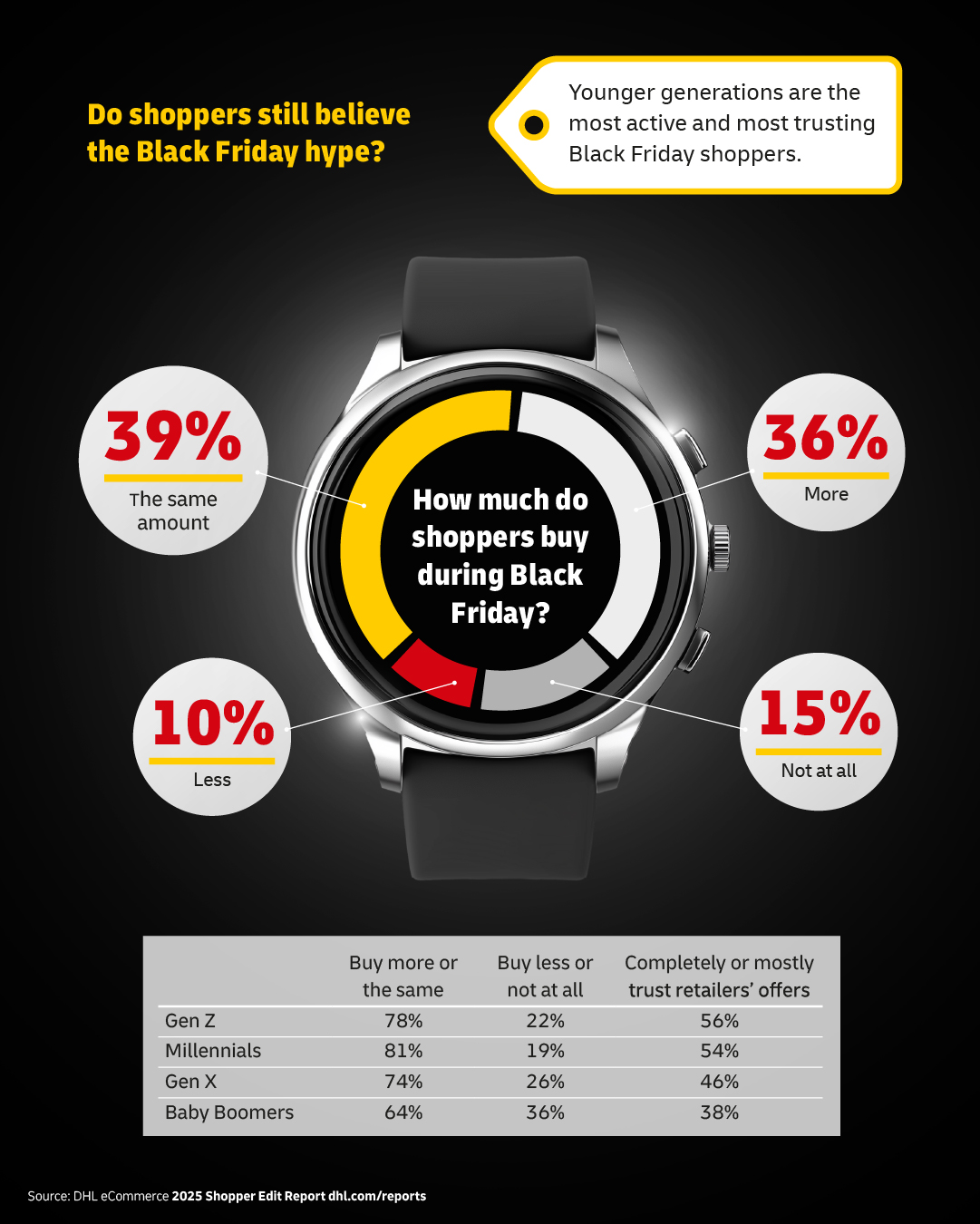

- While 69% of retailers believe customers trust their offers, only 50% of shoppers say they completely or mostly trust Black Friday offers - revealing a perception gap

- Generational trust tells a striking story: 56% of Gen Z trust retailers' prices, compared to just 38% of Baby Boomers

Bonn - Black Friday is just around the corner, and with November and December identified as the busiest trading months for retailers, Black Friday acts as a catalyst for year-end performance. According to insights drawn from the fourth edition of the DHL eCommerce Trends Report: Shopper Edit, which surveyed 24,000 online shoppers across 24 global markets, and the inaugural Business Edit, which gathered responses from 4,050 businesses across 19 countries, 84% of online retailers confirming participation in Black Friday 2025.

However, confidence in the offers surrounding the shopping event appears to be waning. While 69% of retailers believe customers trust their offers, only 50% of shoppers say they completely or mostly trust Black Friday offers. Generational trust tells a striking story: 56% of Gen Z trust retailers' prices, compared to just 38% of Baby Boomers. Generation Z leads not only in trust but also in purchase intent: 81% plan to buy more during the shopping event, compared to 64% of Baby Boomers. Notably, 56% of retailers report selling more during Black Friday compared to other periods, and 60% saw sales on this specific day increase in 2024 versus 2023, with large businesses leading at 69% growth. Sole traders and micro businesses are the least confident about Black Friday this year - expecting more modest results, with only 48% seeing increased sales and only 57% believing that shoppers trust their offers and prices.

Customer reviews influence shoppers

Whilst on the shopper side three out of four shoppers buy more or the same during Black Friday largely being motivated by discounts and savings (71%), access to exclusive deals (49%) and limited-time offers (44%). Real voices influence their choices - 64% of Black Friday shoppers are influenced by customer reviews on social media. Products trending on social media likely attract these shoppers. Their temptation to shop when offers are available goes beyond Black Friday, with 53% saying they shop more when they receive an offer or discount code from a retailer. They're also not afraid to look further afield for a great deal with 62% stating they buy from retailers in other countries. And it's the delivery offering that seems to secure the sale - with 82% of Black Friday shoppers stating they would abandon their basket if their preferred delivery option is not offered at the checkout. Black Friday Shoppers want free delivery - and they're more selective about who they buy from based on delivery and return policies.

Pablo Ciano, CEO at DHL eCommerce: "Black Friday is no longer just about discounts, it's about trust and experience. Retailers must focus on transparency, authenticity, and seamless delivery options to win loyalty. At DHL eCommerce, we see technology and trust as the twin engines driving growth, and we're committed to helping businesses leverage these to succeed - not just during Black Friday, but in the long-term trust economy.''

Strategic growth engine for B2B E-tailers

In 2025, 85% of B2B sellers plan to participate, reinforcing its increasing influence on business buying cycles. 63% of B2B retailers saw higher Black Friday sales last year, and nearly half (48%) outperformed their typical sales during this period. For B2B brands, Black Friday is a strategic lever to win new customers and re-engage existing ones through timely, limited-time offers. However, trust remains a consideration as 67% of B2B e-tailers believe customers trust their offers, slightly below the global 69% average across all businesses surveyed.

It's a billion-dollar business, and brands that prioritize clear pricing, honest promotions, and offer shoppers the delivery options they want stand to make big gains-not just on Black Friday or Cyber Monday, but in the long-term trust economy.

To explore all the key findings, visit: www.dhl.com/reports

*Infographics, charts, or regional breakdowns are available for media use upon request.

Jessica Balleer

DHL eCommerce

DHL Group

Charles-de-Gaulle-Str. 20

53113 Bonn

Germany