Finance Strategy

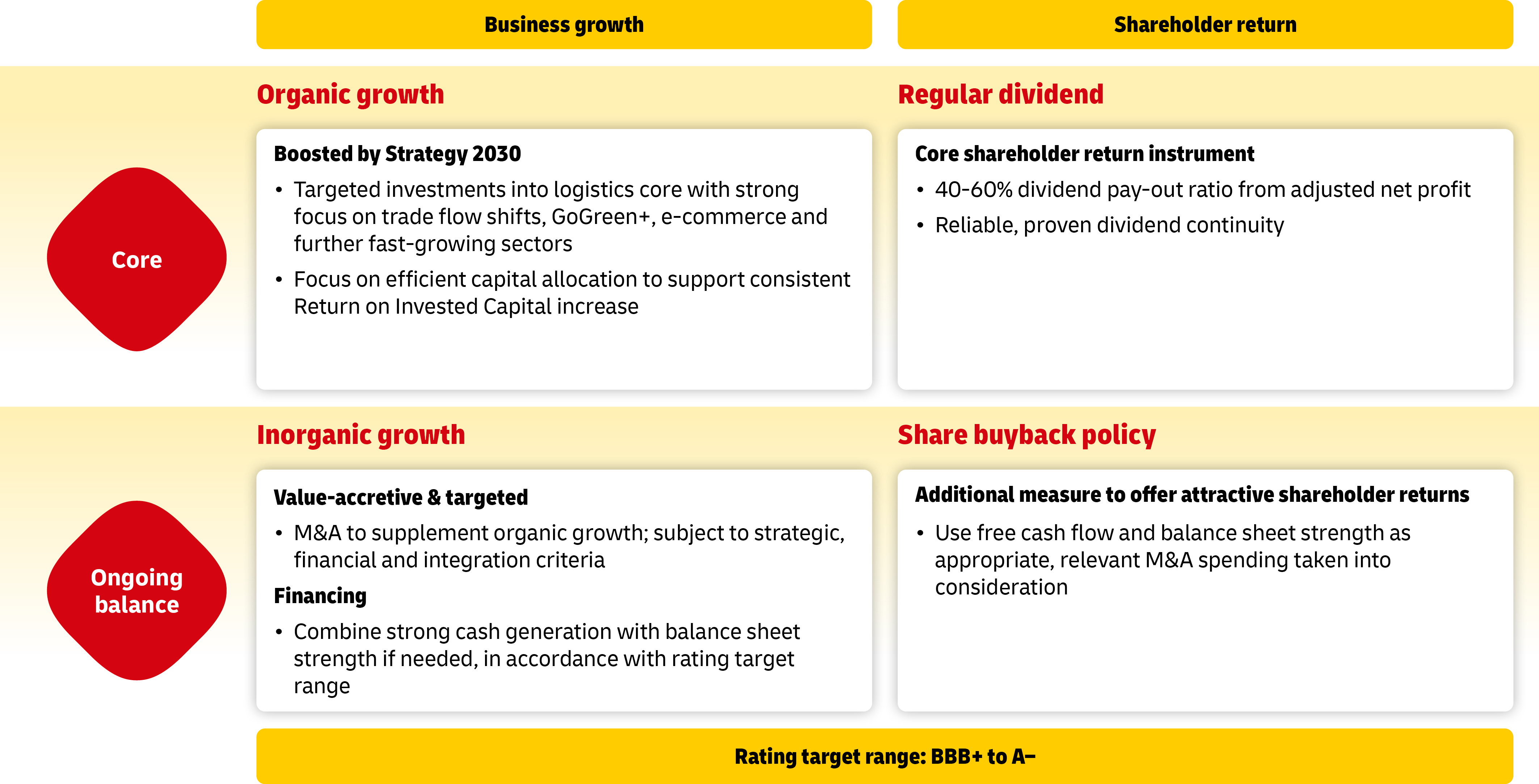

Building on the principles and objectives of financial management, and in light of the Group’s Strategy 2030, the Group Board of Management updated the finance strategy. It takes into account the shareholders’ interests and the lenders’ requirements, focusing on value creation through a transparent and effective allocation of capital. It also aims to maintain financial flexibility and a low cost of capital for the Group with a high degree of continuity and predictability for investors, and to support the Group’s ESG Roadmap.

One key component of the finance strategy is a stand-alone target rating between “Baa1” and “A3” and “BBB+” and “A–,” respectively. The finance strategy also sets clear priorities for the allocation of available liquidity and the strength of the balance sheet. Funding business operations, financing organic investments and making regular dividend payments are given precedence. Thereafter, additional dividend payments or share buybacks as well as inorganic growth will be considered.