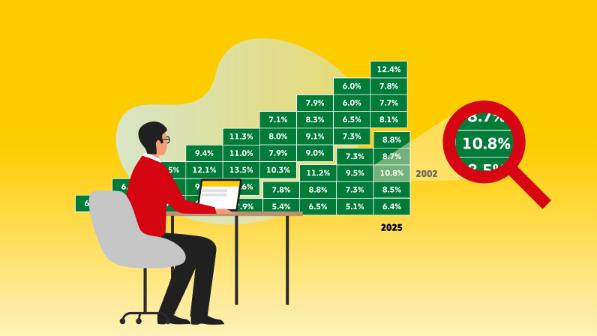

Share Performance

10.8% total return on average

...was achieved by an investment in Deutsche Post AG made at the end of 2002 if it was held until the end of 2025. This and further information regarding the share performance since the IPO can be found in our total return triangle.

Key figures on our shares

Shares of Deutsche Post AG, multi-year-overview

| 2020 | 2021 | 2022 | 2023 | 2024 | ||

| Basic earnings per share1 | € | 2.41 | 4.10 | 4.41 | 3.09 | 2.86 |

| Diluted earnings per share2 | € | 2.36 | 4.01 | 4.33 | 3.04 | 2.81 |

| Cash flow per share1, 3 | € | 6.22 | 8.11 | 9.03 | 7.79 | 7.48 |

| Dividend per share | € | 1.35 | 1.80 | 1.85 | 1.85 | 1.85 |

| Dividend distribution | € m | 1,673 | 2,205 | 2,205 | 2,169 | 2,1324 |

| Number of shares as of December 31 | millions | 1,239.1 | 1,239.1 | 1,239.1 | 1,239.1 | 1,200.0 |

| Year-end closing price | € | 40.50 | 56.54 | 35.18 | 44.86 | 33.98 |

- 1

- The average weighted number of shares outstanding is used for the calculation.

- 2

- The average weighted number of shares outstanding is adjusted for the number of all potentially dilutive shares.

- 3

- Cash flow from operating activities.

- 4

- Estimate.

General information on our shares

Deutsche Post shares

| Listed since | 20 November 2000 | |

| Issue price | € | 21.00 |

| Instrument type (class) | non-par value registered ordinary shares | |

| Authorized capital | € | 1,150,000,000 |

| Authorized capital | no. of shares | 1,150,000,000 |

| Share capital | € | 1,150,000,000 |

| Accounting standard | IFRS | |

| Fiscal year ends | 31 December | |

| International Securities Identification Number (ISIN) | DE0005552004 | |

| German securities code number (WKN) | 555200 | |

| Exchange symbol | DHL | |

| Instrument Code Reuters | DHLn.DE | |

| Ticker Symbol Bloomberg | DHL | |

| Paying Agent | Deutsche Bank AG, Taunusanlage 12, 60325 Frankfurt am Main | |

| Stock exchange centres | Frankfurt/M., Xetra | |

| Prime sector | Transportation & Logistics | |

| Industry group | Logistics | |

| Segment | Regulated Market (Prime Standard) | |

| Affiliation to German stock exchange indexes | PRIME ALL, CDAX, HDAX, DAX | |

American Depositary Receipts (ADRs)

American Depositary Receipts (ADRs) are negotiable instruments issued by J.P. Morgan Chase Bank that evidence ownership of shares in Deutsche Post AG. Each ADR represents one underlying ordinary share of Deutsche Post AG, on deposit with J.P. Morgan Chase Bank in Germany.

General Information

| Symbol | DHLGY |

| Exchange | Over the counter (otc) |

| Ratio | 1 ADR : 1 ORD |

| CUSIP | 25157Y202 |

| Underlying Sedol | 4617859 |

| US ISIN | US25157Y2028 |

| Underlying ISIN | DE0005552004 |

| Depositary Bank | J.P. Morgan Chase Bank, NA Online via Email: web.queries@computershare.com Address Computershare Trust Company, N.A. PO Box 43304 Providence, RI 02940-3304 Telephone Calling from inside the US: +1 888-697-8018 (toll-free) Calling From outside the US: +1-781-575-2844 |